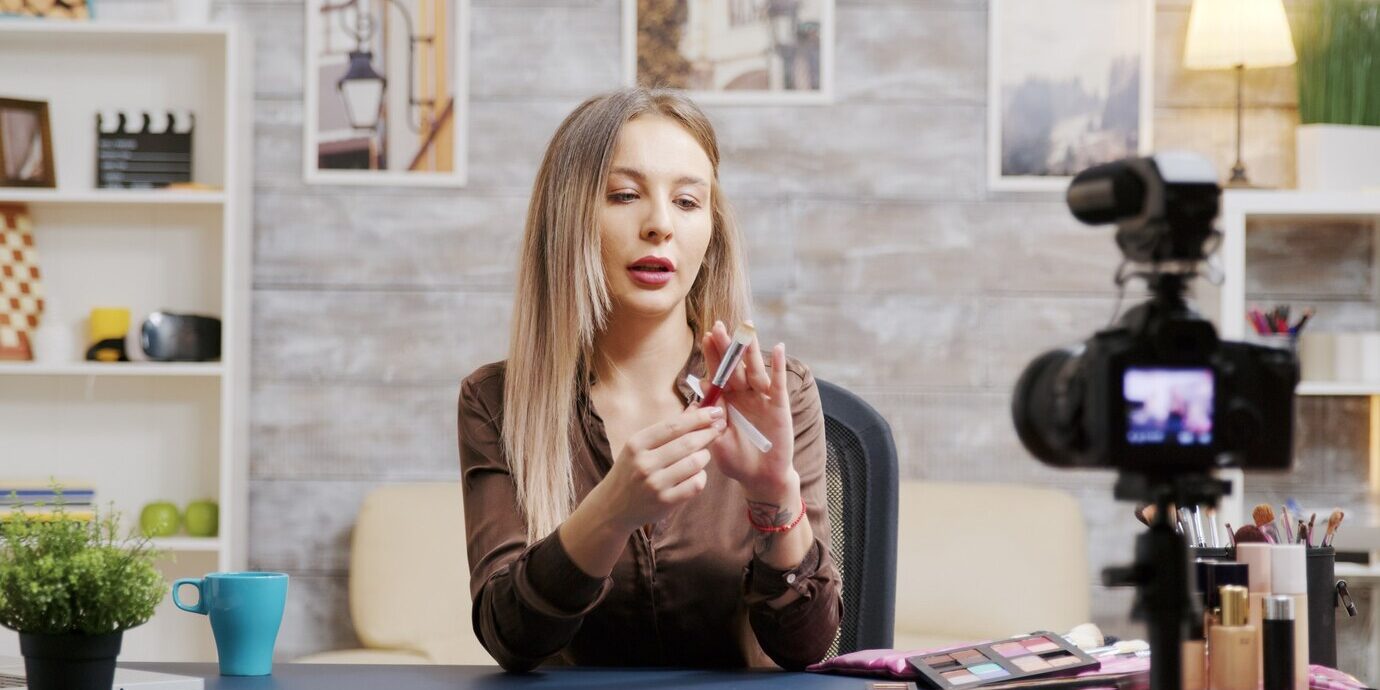

At Stratos Accounting & Consulting, we understand the unique financial challenges that come with being an influencer, YouTuber, blogger, or streamer. Managing your taxable income, keeping up with tax compliance, and staying on top of business expenses can be overwhelming—especially when your focus is on growing your brand. That's where we come in. Our team specializes in helping content creators and social media influencers maximize their earnings, optimize their taxes, and stay compliant with CRA regulations so they can focus on what they do best.

Professional Accounting Services for Influencers & Digital Creators

Your income streams as an influencer are different from those of a traditional business, and your accounting needs to reflect that. Stratos Accounting & Consulting offers customized solutions designed specifically for content creators. Whether your earnings come from sponsorships, affiliate marketing, brand deals, or crowdfunding platforms like Patreon, we provide expert bookkeeping services to help you track revenue, manage business expenses, and minimize tax liability.

Tax Planning & Compliance for Influencers

Taxes can be complicated when you're self-employed, but they don't have to be stressful. Our tax professionals help influencers with income tax filing, HST/GST registration, and identifying deductions for content-related expenses. We'll ensure you're taking full advantage of tax benefits while fully complying with CRA regulations. From structuring your taxable income to ensuring smooth tax compliance, we help digital entrepreneurs retain more of what they earn.

Revenue Tracking & Financial Reporting

With multiple income streams—like YouTube ad revenue, Instagram partnerships, Twitch subscriptions, and affiliate marketing—keeping track of earnings can be a challenge. That's why accurate bookkeeping services and financial reporting are essential. We help influencers stay on top of their business income, track cash flow, and ensure they always know where their money is going. Clear financial reporting also helps with budgeting and making informed business decisions.

Business Expense Deductions for Influencers

Did you know that many of the tools and expenses that help you create content can be deducted from your taxes? Our team helps influencers identify business expenses that qualify for tax deductions, including:

- Cameras, lighting, and computers

- Home office costs, such as rent, utilities, and internet

- Travel expenses related to brand partnerships and content creation

- Software subscriptions and production costs

We ensure you maximize your deductions to reduce your taxable income and keep more money in your pocket.

Incorporation & Business Structuring for Influencers

Is incorporating the right move for you? As an influencer, choosing between a sole proprietorship and incorporation can have big financial implications. Our tax experts help you weigh the tax advantages, liability protection, and long-term financial benefits of incorporation so you can make the best decision for your business. Whether you're just starting out or ready to take your brand to the next level, we'll guide you through the process.

Why Influencers Need a Specialized Accountant Specialized Accountant

Unlike traditional businesses, influencers face unique financial challenges, such as:

- Fluctuating income from sponsorships and partnerships

- International payments and currency exchange complexities

- Tax reporting for multiple monetized platforms like YouTube, Instagram, and Twitch

- Managing business expenses while ensuring CRA compliance

Working with a tax professional who understands the influencer industry can save you time, money, and unnecessary stress.

Benefits of Using Influencer Accounting Services

Partnering with an experienced accounting firm like Stratos Accounting & Consulting comes with a lot of perks:

- Lower tax liability through smart planning and deductions

- Better financial organization with reliable bookkeeping services

- Full CRA compliance to avoid fines and audits

- Expert advice on managing business income and growth

- Hassle-free income tax filing and HST/GST registration

Stratos Accounting & Consulting: Accounting Experts for Influencers & Creators

At Stratos Accounting & Consulting, we're more than just accountants—we're financial partners for content creators and social media influencers. Our deep knowledge of influencer tax compliance, financial management, and bookkeeping services makes us the go-to accounting firm for digital entrepreneurs. Whether you need help with tax advantages, revenue tracking, or business structuring, our team of tax experts is here to help you succeed.

Request a Free Consultation

Want to take control of your finances and focus on growing your brand? Contact Stratos Accounting & Consulting today for a free consultation. Our tax professionals are ready to simplify your accounting needs and help you achieve financial success.